Conventional Home Loan Requirements

When buying a new home, there are plenty of options of ways to make that big purchase.

Most people won’t have cash to pay the entire home purchase amount, so instead they may choose to borrow money through a mortgage or home loan.

The two main types of loans are government-backed loans and conventional loans. Loans backed by the government are FHA loans, USDA loans or VA loans.

Conventional loans are backed by financial institutions and usually have a down payment requirement.

There are many different types of mortgages available, and it can be confusing to figure out which one is right for you.

In this post, we will discuss the conventional loan requirements and who qualifies for them.

We will also outline the process of applying for a conventional loan and what you can expect during the application process.

When is a conventional loan a good idea?

Conventional loans can have low interest rates, they usually require less paperwork and often can be obtained more quickly than a government loan. They’re best suited for buyers who have:

- Great credit: To qualify for a conventional loan, your credit score should be 620 at minimum. The higher your credit score, the higher the probability of a better rate. The lender wants to ensure that you have a history of managing credit responsibly.

- Low debt-to-income ratio: By adding all your monthly debt payments divided by monthly income before taxes, you can calculate your debt-to-income ratio. The debt-to-income ratio should be below 45% to qualify for a conventional loan. (Make sure to include the mortgage payment in the ratio)

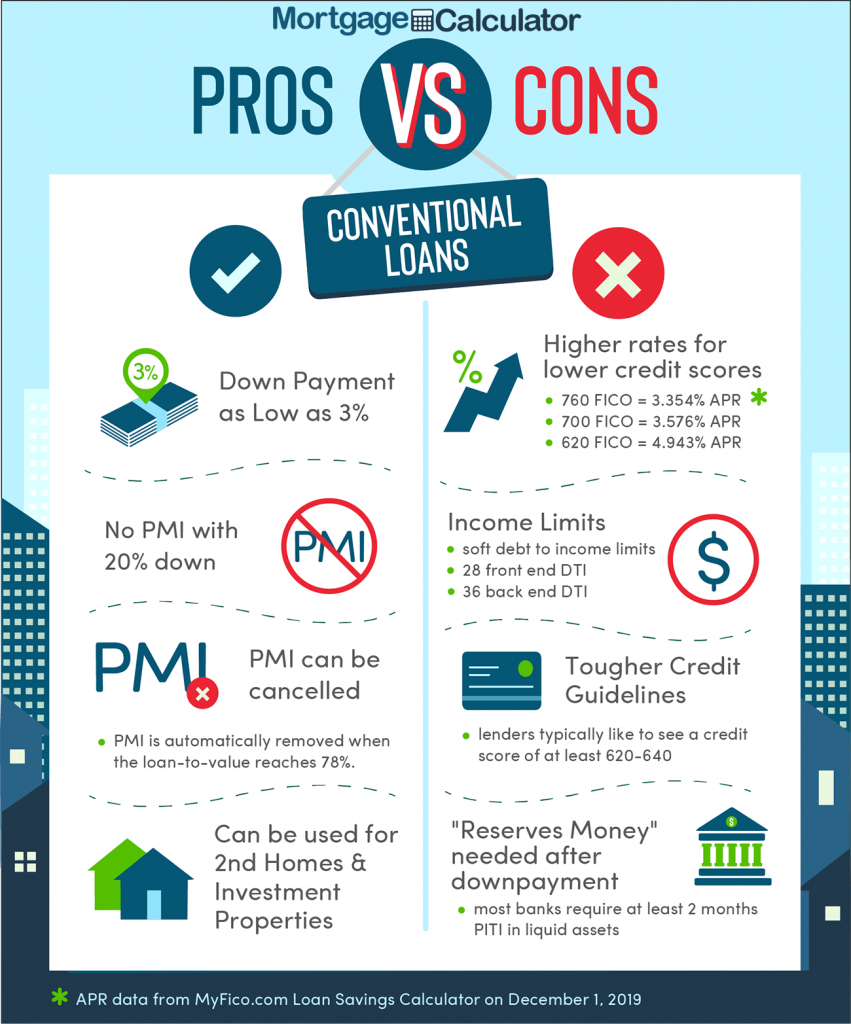

- Down payment: While the minimum down payment is 3% with a conventional loan, more is preferred.

Note: A first time home buyer can now qualify for a conventional loan with a down payment as low as 3% if the purchase price is $726,200 or below.

While there are other factors that might be part of your decision, these are the main ones that can help determine if a conventional loan is the right option.

What can negatively affect your conventional loan eligibility

- No Credit History. It’s difficult to determine if you can pay bills on time without a credit history.

- Bankruptcy. It does not disqualify you from obtaining a conventional loan but will require a more in-depth credit review. For Chapter 7 bankruptcy, at least four years must have elapsed and have re-established credit.

- Late Payments. It’s best to apply for a conventional loan when you have a solid 12 months of on-time payments for all financial obligations.

- Foreclosure. Past foreclosures are not necessarily a roadblock to a conventional loan, but it depends on the circumstances. A minimum of 7 years must have elapsed to qualify.

- Collections, Judgements, and Federal Debt – In general, convenional loan requires that judgments are resolved prior to or at closing. Collection accounts may be required to be paid off depending on the circumstances, and all Federal debt must be in good standing.

Note: If it sounds like a conventional loan isn’t for you, check out these loans that have much more lenient guidelines.

Types of loan programs Coole Home loan officers can help you with:

- FHA loan – A popular home loan for first time home buyers due to it’s lenient guidelines and low down payment of 3.5%

- VA home loan – perfect for veterans and active duty military members. Easy to qualify for and no down payment required.

- Jumbo Loan – A mortgage program used to finance properties that are too expensive for a conventional conforming loan.

- Bank Statement program– Great for borrowers who don’t want to provide their tax return for income quafifciation.

Conventional Mortgage vs. FHA

Conventional Loans are a great option, but for borrowers who have lower credit scores under 660 and higher debt to income ratios, an fha loan with mortgage insurance might be a better option.

A buyer can get a conventional home loan with a 3% down payment, and have a lower monthly mortgage insurance payment.

With FHA loans the mortgage insurance payment is higher and the minimum down payment is 3.5% BUT the FHA loan typically has a lower interest rate.

Mortgage insurance on an FHA cannot be removed. It will remain on the loan for life. On a conventional loan PMI is removed once you hit 78% loan to vlaue.

Read more: Conventional vs. FHA

Conventional Down Payment Options

The down payment is a percentage of a home’s purchase price that is used to pay for the home.

The down payment amount is then deducted from the cost of the home, and the remainder is the amount of loan or mortgage that’s required.

The down payment varies depending upon the type of home and your purchasing situation. It will also vary depending upon your credit score and debt-to-income ratio.

For a conventional loan, the absolute minimum down payment required is 3% and that home must be a primary residence and you must be a first-time home buyer. The purchase price must be at $647,200 (conforming loan limit) or less to qualify for a 3% down payment.

For anyone not a first-time buyer, a minimum amount of 5% is required.

If the home you’re buying is a second home, then you’ll need a down payment of at least 10%.

And then if the home is not a single-family home, or has more than one unit, then you will need to put 15% down.. If you are looking to buy a home above $647,200, you’ll need a high balance loan.

Learn more: Conventional loan down payment options

Jumbo Loans

A jumbo loan is a mortgage that is larger than $726,200 . Jumbos are available in both fixed-rate and adjustable-rate formats, and they can be used to purchase any type of property.

Jumbo loans can be used for a variety of purposes, including buying a home, refinancing your mortgage, or consolidating debt. If you are in need of a large loan amount and don’t want to go through the hassle of getting a private loan, then a jumbo loan may be right for you!

All about PMI (Private mortgage insurance)

Any down payment below 20% also requires PMI, also known as private mortgage insurance. This PMI is required because the loan is considered a bigger risk to the lender. PMI can cost between .5% or 1% of the mortgage and is always rolled into the monthly mortgage payment.

Once you’ve paid enough of the mortgage principal, the PMI can be dropped. This basically happens when the principal mortgage balance is 80% of the home’s original value, which means that you have 20% equity in your home. At that point you can request that the lender remove PMI from the loan. It may automatically be removed when your mortgage balance is 78% of the home’s original value, or you’ve reached 22% equity in your home.

Types of conventional loans

Conventional loans are typically split into two types: conforming and non-conforming.

Fannie Mae and Freddie Mac are the two biggest entities in the U.S. that are responsible for mortgages.

They are government-sponsored businesses that purchase mortgages from lenders, and set specific guidelines for lenders to follow.

Conforming loans must meet guidelines set by Fannie Mae and Freddie Mac. Guidelines include credit score, down payment amount, income requirements, and loan limits.

A non-conforming conventional loan doesn’t have any loan limits. It’s also known as a jumbo loan. This type of loan would be backed by a private investor or financial institutions instead.

Fixed-rate conventional loans keeps the interest rate the same no matter how long you have your mortgage which also means your mortgage payment will stay the same.

These loans can be up to 30 years long, meaning that the interest rate is locked in for the entire 30 years of the mortgage.

When interest rates are low, this is the best option when making a home purchase.

Fixed-rate loans could also be acquired for 10, 15, 20, or 30 years. The shorter term of the loan, the lower the interest rate will most likely be. However, a shorter term will reflect a higher monthly payment than a 30 year mortgage.

Another option is an adjustable-rate mortgage, in which case the rate fluctuates over time. These ARMs usually have a fixed rate for the first 5 to 10 years. The rate will rise or fall along with federal interest rates after the predetermined time of three, five, seven or ten years.

This could be a good option if a home buyer is going to live in the home for a shorter period of time and the interest rates are fairly high.

Why a conventional loan?

Many home purchasers can get lower interest rates with a conventional loan provided they have good credit and can make a solid down payment.

The entire process is also usually quicker with a conventional loan, and there aren’t the same restrictions on the type of home that can be purchased that might be encountered with a government-backed loan.

Related: Why Should I Pursue a Conventional Loan Over a Government Loan?

Going with a conventional loan offers more flexibility in the home that you want to buy. You’re not restricted to a home that is only a single family residence, or one that is going to be used as a secondary home or rental property.

You’ll also want to ensure that you can qualify for a conventional loan based on debt-to-income ratio, credit score, and down payment available.

In the long run, a conventional loan may save you money and time if you’re in a good financial situation. You’ll need to explore your finances and options before making a decision, and determine which loan is the right choice and the most affordable one.