Once your loan-to-value (LTV) ratio drops to 80%, you can request for the PMI to be removed.

The monthly premium for PMI is typically added to your mortgage payment.

If you have private mortgage insurance (PMI), you may be able to remove it after you have built up enough equity in your home.

The benefit of removing PMI would be to lower your monthly payment.

This article provides clear instructions on how to remove PMI from a mortgage. By following these simple steps, homeowners can save money every month and eventually get out of debt faster.

What is PMI?

PMI is an insurance policy that protects the lender, against any losses that can occur when a borrower stops making payments on their mortgage.

How to get rid of PMI

Assuming you have a conventional loan and are not behind on your payments, there are three ways to get rid of PMI.

First

The first is to simply wait it out. By law, lenders must automatically cancel PMI when the outstanding principal balance of your loan falls to 78% of the original value of your home.

This can take up to 10 years or longer, depending on how much you initially borrowed and the size of your down payment.

Second

The second way to get rid of PMI is by asking your lender to remove it. Lenders are required to review your account once a year and determine if you still pose a high-risk for default.

If they determine that you don’t have a high risk, and you have enough equity, they are then required to remove PMI from your mortgage within 45 days.

Third

The third way to remove PMI is to refinance your mortgage once you have enough equity.

Equity is the difference between what your home is worth and how much you still owe on it.

So, if your home is worth $550,000 and you have a loan for $300,000, then your equity is $250,000.

Once your equity reaches 20% of the appraised value, you can refinance to have PMI removed.

80% LTV means you have 20% equity in your home. 78% LTV = 22% equity in your home.

Automatic Cancellation

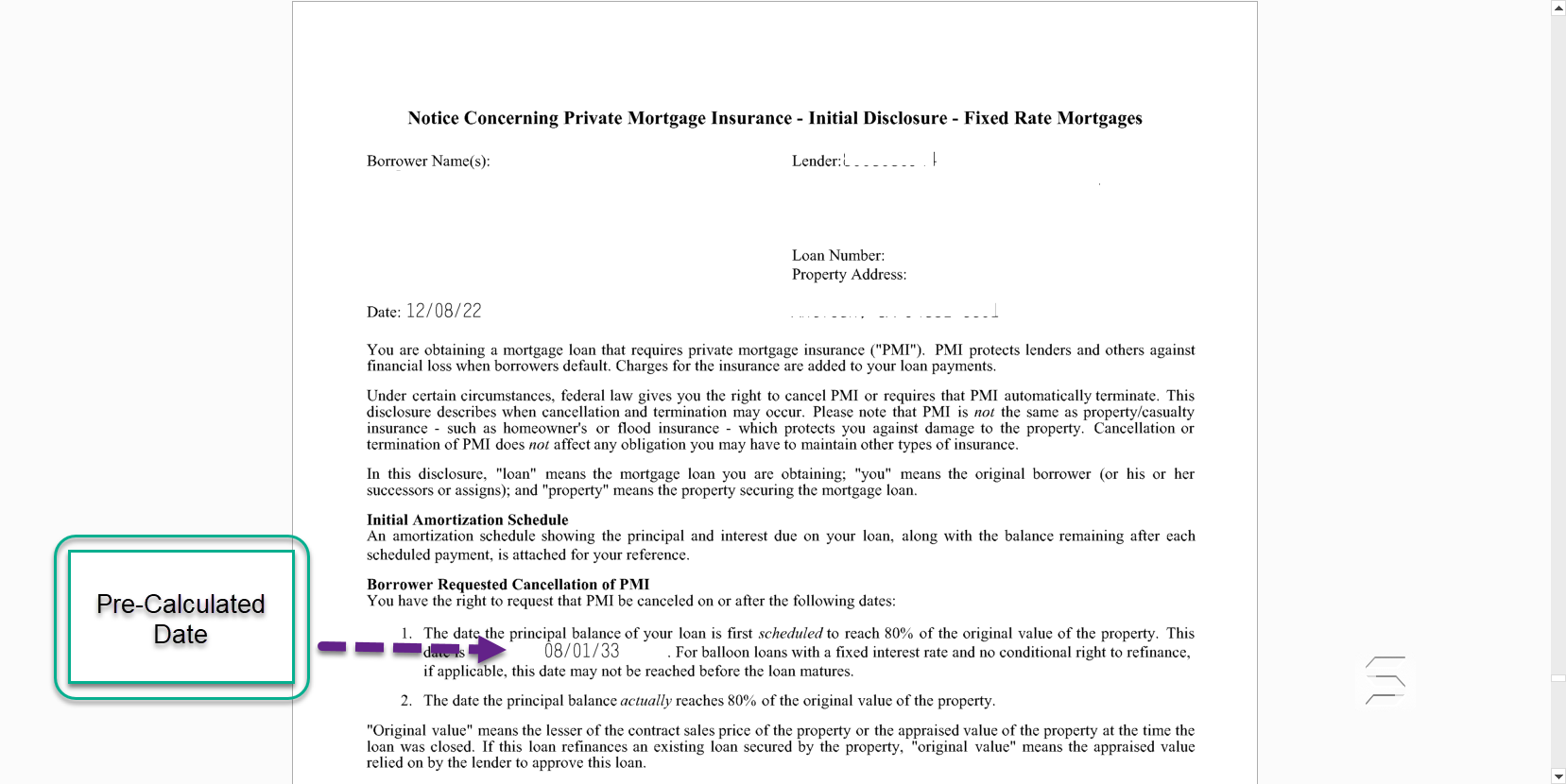

If you’ve made your mortgage payments on time, your PMI will automatically be removed at a date pre-calculated in your PMI disclosure, which you would have gotten when you closed on your house.

If you don’t have this, you can request a copy from your mortgage company.

Here is a sample PMI disclosure.

Requesting Cancellation Sooner

Your LTV must be at 80% LTV to request the PMI cancellation earlier than the scheduled fall off date.

To request, call your mortgage company and let them know you’d like to remove the PMI.

A few requirements for PMI removal

- No other liens on the property.

- A good payment history could be required. If you are in default, the lender may not cancel the PMI.

- The lender may want to confirm that your property has not declined from its original value. An appraisal could be required.

More info: What is the process of an appraisal?

What Happens if the Lender won’t remove the PMI?

If you are having a hard time getting the PMI removed, you can do a refinance.

A refinance will result in a new loan with new terms and an appraisal will most likely be required to determine the current value.

Refinancing does have closing costs. Make sure that the cost of the refinance will actually save you money.

- Conventional loan – the LTV must be at 80% or less for no PMI.

- VA loans don’t have PMI

- FHA loans will have PMI even at 80% LTV.

For FHA loans the PMI works differently. You can learn more about the FHA requirements here.

How to avoid paying PMI in the future

The easiest way to avoid paying PMI in the future is to put down at least 20% when you purchase your home.

Making less than a 20% down payment will always require a PMI policy, unless you are buying a home with a VA loan.

We hope that this article has been helpful in providing you with the information you need to make a decision about your financial future.

Are you ready to apply? Start the process by completing the form below.