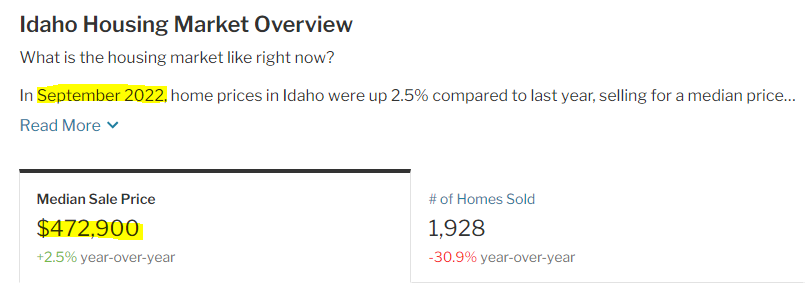

Homes are selling for a median price of $472,900 in Idaho, according to Redfin, and homes sell in an average of 31 days.

These numbers can be scary if you’re buying a home for the first time, but it’s easier than you might think.

Check latest median price here.

Use these helpful tips to save enough money and ensure you get approved to buy a home in Idaho.

Save for a Down Payment

You’ll need a down payment in most cases to buy a home.

You should have 20% down payment, that can seem like a lot to most people, so, fortunately, there are other options.

FHA loans require only 3.5% down.

VA and USDA loans don’t require a down payment, and even conventional loans require as little as 3% down for first-time home buyers.

If you make less than a 20% down payment, you’ll pay private mortgage insurance until you owe less than 80% of the home’s value.

Read: Mortgage Down Payment Options

If you don’t have money to put down, consider looking into Idaho’s down payment assistance programs.

Many options exist, such as the down payment / closing cost assistance program from the Idaho Housing and Financing Association.

Get Pre-Approved

Before you look at homes, getting pre-approved for a mortgage is a must.

By going through the mortgage pre-approval process – you’ll know how much you can get pre-approved for and if you need to work on anything to get the rate and terms you want.

When you first apply for a loan, you provide the lender with basic paperwork.

This usually includes:

- Paystubs for the last 30 days

- W-2s from the last two years

- Tax returns from the last two years (if self-employed or working on commission)

- Two months of bank statements

- Identification

Then, your credit will be pulled to determine your debt-to-income ratio and see which loan program you might qualify for based on your financial factors.

Or if you are just starting the process and have an interest in buying a home but aren’t fully committed yet, get a pre-qualification.

A pre-qual is an evaluation of what you “can” qualify for based on information that you provide.

There is no affect on your credit score by doing a pre-qual.

Read more about it here: How to Know What You’re Qualified For When Buying a House

When you are serious about moving forward just note that sellers want a pre-approval letter to ensure you are a good risk before showing you their home.

They typically don’t accept offers from Non pre-approved buyers.

Find the Perfect Home in Idaho

Once pre-approved, you’re ready to start looking at homes.

A pre-approval letter lasts 120 days, so ensure you are diligent in your efforts, or you’ll have to get pre-approved again.

Consider the location, the home’s features, and how much you want to spend based on your budget.

Don’t lose track of your goals and bid more than you can afford and regret it later.

Instead, it’s best to work with a reputable real estate agent who understands your budget and will keep you on track.

Finalize the Mortgage Underwriting

After you sign a sales contract, the lender will order an appraisal and title work on the home.

They must determine that the home is worth at least as much as you offered and that there aren’t any liens because liens follow the home, not the person.

The mortgage underwriter will review your file and may request some paperwork to finalize your file for closing.

Once you clear the conditions, you’re on the path to owning a home.

Final Thoughts

Buying a home in Idaho is exciting and easier than most people think.

A large down payment isn’t necessary, and you may even get assistance with it. In addition, there are many loan programs, so finding the best program for your budget can help you buy a home faster than you thought possible in Idaho.

We recommend talking to a mortgage loan officer to figure out what your options are.

Are you ready to apply? Start the process by completing the form below.