Sick of Saving for Closing Costs? Here’s What You Need to Know

Taking advantage of lender credits can save you thousands of dollars upfront, leaving you more money for a down payment.

See Also:

- Closing Costs – How Much are Costs & Who Pays Them?

- Can Closing Costs be Rolled Into a Conventional Loan?

Are you dreaming of owning a home but can’t quite afford the hefty closing costs?

Lender credits could be the answer! While they come with a catch, they can help lower your upfront costs and get you into your dream home faster.

Learn about the benefits, trade-offs, and alternatives to make an informed decision.

Don’t let closing costs stand in the way of your homeownership dreams.

Lender Credits

Let’s talk about lender credits, folks!

These are funds provided by your mortgage lender to help cover some of your closing costs, which can be a lifesaver when you’re already stretched thin.

However, before you start doing cartwheels, it’s essential to understand that this kind of credit isn’t free money.

In exchange for lender credits, you’ll agree to pay a slightly higher interest rate on your loan, which means your monthly payments will also be a bit higher.

While lender credits can help you pay less upfront, they could cost you more over time.

Think of it like a cash advance from your credit card.

Sure, it’s nice to have some extra dough in your pocket now, but you’ll pay for it later with higher interest rates.

That being said, if you’re struggling to come up with the cash for closing costs, lender credits could be a game-changer for you.

Just make sure to weigh the pros and cons carefully before making a decision.

We’ll give you the inside scoop on how lender credits work, including the pros and cons. This will help you decide whether a lender credit is a right choice for you.

See also:

How to know what you qualify for

How Lender Credits Work

Some mortgage lenders offer lender credits to cover some or all of your closing costs.

However, the borrower agrees to a slightly higher interest rate on their mortgage loan in exchange for this benefit.

While taking advantage of lender credits can save you thousands of dollars upfront, keep in mind that it may lead to higher monthly mortgage payments in the long run.

This means that your mortgage could end up being more expensive over time.

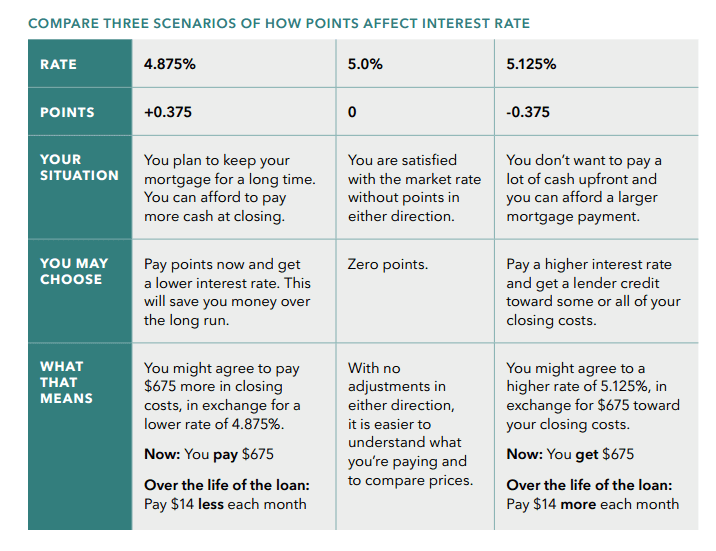

The image above should provide a better idea of what the rate difference looks like. The larger the lender credit, the higher the rate.

Lender credits are a great way to cover some of the costs associated with closing on a home.

Know Your DTI (Debt-to-Income Ratio)

Debt-to-income (DTI) ratio is a financial metric that compares your monthly debt payments to your monthly income. It’s used by lenders to assess your ability to repay a home loan.

Here’s what you need to know about what lender credits can and can’t be used for.

Lender credits can be used to cover all the closing costs, including title and escrow fees, attorney fees, prepaid property tax, homeowners insurance, origination fees, inspections and survey costs, county recording fees, etc.

But wait, there’s more!

Unfortunately, there are some things that lender credits can’t be used for.

You can’t use them to cover expenses required to finance a mortgage, such as the down payment or cash reserves required by the lender.

So, while lender credits can greatly help reduce the financial burden of closing costs, it’s important to remember that they can’t cover everything.

Next up:

The trade-off for a lender credit – Does it make sense?

Let’s talk about the trade-off when it comes to lender credits.

While these credits can be a great help in covering closing costs, they come at a price: a higher interest rate on your mortgage loan.

It’s important to understand that there is a point where the increased monthly payments from the higher interest rate will wipe out the savings you received from the lender credit.

This is called the “break-even point.”

Knowing the break-even point is crucial because it allows you to determine how long it will take for the higher interest rate to start costing you money.

Depending on your plans for carrying the loan or selling the property, this information can help you decide whether negotiating a higher rate in exchange for lender credit makes sense for your situation.

So, while lender credits can be a lifesaver for some, it’s important to crunch the numbers and weigh the long-term costs and benefits before making a decision.

After all, you don’t want to end up paying more in the long run just to save a few bucks upfront.

Who can benefit from a lender credit?

Let’s take a closer look at the benefits of lender credits.

While opting for lender credits means you’ll pay more in interest over the life of the loan, some valuable advantages might make them a smart choice for specific borrowers.

First off, lender credits can help you purchase a home sooner.

If the increased interest rate is offset by the amount you’d be paying for rent while you continue to save for a home, then lender credits can get you into a home faster and help you start building equity wealth.

Additionally, if you plan on selling your property within a few years, then lender credits can be a real money-saver.

While higher interest rates mean you’ll pay more over the loan term, those savings can be dwarfed by the thousands of dollars you’d otherwise be paying in closing costs.

Lender credits can also be helpful for borrowers who want to avoid paying private mortgage insurance (PMI) on a conventional mortgage.

By applying what they would have paid for closing costs toward their down payment, borrowers can potentially reach the 20% down payment threshold required to avoid PMI.

If the lender credit doesn’t make sense

If lender credits aren’t the right fit for your situation, there are other options available to help cover your closing costs:

Increase your savings: If possible, consider delaying your home purchase for a few months or years to save up more money to cover your closing costs.

This may also allow you to put down a larger down payment, which could lead to better financing options.

Negotiate with the seller: Consider asking the seller to pay for a portion of the closing costs or accept a lower sale price on the home. Keep in mind that this may be more difficult in a competitive seller’s market, when inventory is low.

Apply for closing cost assistance: There are various programs available that can help first-time homebuyers cover closing costs.

Speak with your mortgage lender to see what options are available in your area.

Ask for a gift from a family member: If you have a family member who is willing to gift you money for closing costs, this could be an option.

Make sure to document the gift with a gift letter from the giver and speak with your real estate agent or mortgage lender to understand the requirements.

Are you ready to apply? Start the process by completing the form below.