Principal and Interest on a Mortgage

When you take out a loan, such as a mortgage loan, you make monthly payments that pay off the loan’s principal and also cover the interest charges.

You will pay a signicant amount towards the interest over the life of the loan. You may be shocked, when you see how much it is. But, if you are looking to buy a house, the only way to avoid paying interest is by buying a home with cash.

Most of us don’t have hundreds of thousands of dollars sitting around. Getting a mortgage will be the only option to own a home.

This article is going to explain the differences between principal and interest on a mortgage. Prepared to be shocked.

Understanding the difference between paying off the principal and paying interest

The principal is the amount of money you borrow, while interest is the fee charged by the lender for lending you the money.

In the early stages of a home loan, a more significant portion of your monthly payment goes towards paying the interest, while a smaller bit goes towards paying down the principal.

Over time, as the loan amount you owe decreases, a more significant portion of your payment goes towards paying the principal, and a more minor part goes towards paying the interest.

When you make extra payments towards your loan’s principal, you can reduce the amount of interest you pay over the life of the loan and pay off the loan faster. We’ll get into this a bit later.

Making extra payments can save you money in the long run.

On the other hand, making only the minimum required payment each month means that you will be paying more in interest over the life of the loan.

Interest on the mortgage

The interest on your mortgage is the cost of borrowing the money you need to purchase your home.

This interest is calculated based on the amount of the loan, the interest rate, and the length of the loan.

The interest rate can be either fixed or adjustable, and will have a significant impact on your monthly payments and the overall cost of your loan.

Here is an example of how much you’ll pay in interest when you get a mortgage:

Pay attention to the loan amount which is the amount you borrowed compared to the interest paid on the loan.

This is based on a 30 year mortgage.

| Loan Amount | Interest Rate | Interest Paid in Total | Total Cost of Mortgage |

|---|---|---|---|

| $200,000 | 5.0% | $186,513.24 | $386,513.24 |

| $500,000 | 5.0% | $466,278.27 | $966,278.27 |

| $700,000 | 5.0% | $652,791.31 | $1,352,791.31 |

| $900,000 | 5.0% | $839,303.97 | $1,739,303.97 |

| $1,000,000 | 5.0% | $932,555.88 | $1,932,555.88 |

| $3,000,000 | 5.0% | $2,797,672.91 | $5,797,672.91 |

Principal on a mortgage

The principal is the amount of money you actually borrowed to purchase your home.

For example, if your home cost $500,000 and you put a down payment of $50,000, than you got a home loan for $450,000, the principal portion of your loan would be $450,000.

Interest makes the total amount you pay for your home much higher than the actual purchase price or the loan amount

Your monthly payment will include both interest and principal, with the amount of each component varying depending on the terms of your loan.

Over time, as you make your monthly payments, the amount of interest you pay will decrease and the amount you pay towards the principal will increase, gradually reducing the amount you owe on the loan.

The amount of interest will decrease over time

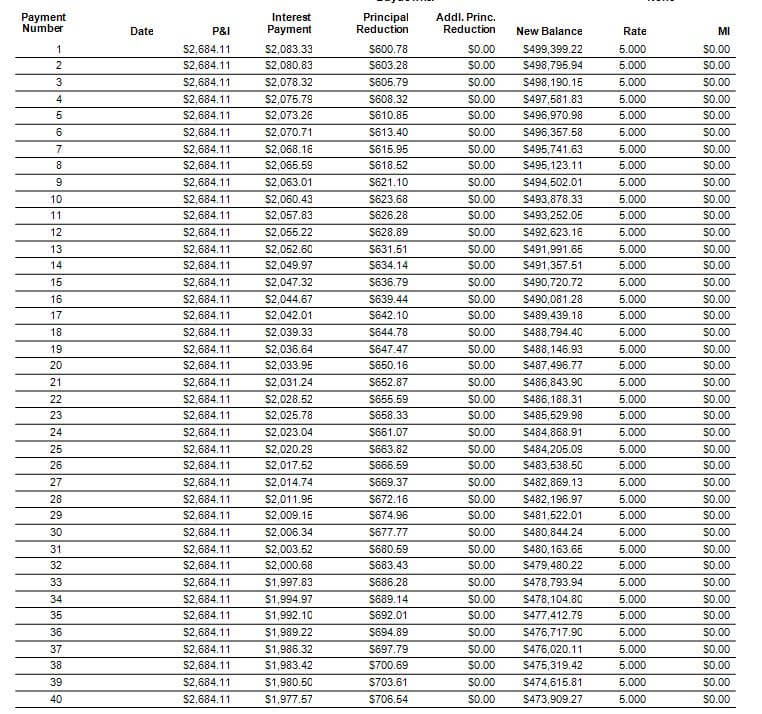

For example, if you borrow $500,000 at a 5% interest rate, your monthly payment will be $2,684.11.

The very first payment will include $2,083.33 in interest and $600.78 towards the principal, the second payment will include $2,080.83 in interest and $603.28 towards the principal.

On the 6th year the Jan mortgage payment breaks down into $1,913.10 in interest charges and $771.01 going to the principal.

At 10 years, Jan payment, your interest payment is $1,742.79 and your principal is $941.32

When you go through the mortgage process, you’ll receive an amortization schedule. The amortization schedule will break down how much is being paid towards the prinicpal and interest on a monthly basis.

Adjustable Rate Mortgages

Some loans, such as those with adjustable interest rates, may have lower interest charges in the loan’s early years that increase over time.

An interest-only ARM is a type of adjustable-rate mortgage where the borrower only pays the interest on the loan for a set period of time, typically 5 to 10 years. During this time, the loan balance does not decrease, and the borrower does not pay towards the principal.

After the interest-only period, the borrower is required to start paying both interest and principal.

Real estate investors usually get interest-only ARM loans on their rental properties because the payments for the first 5-10 years is lower since it is interest only. It is not recommended to get this type of a loan on a primary residence that you plan on living for a long time.

15 year Vs 30 year mortgage Check out the difference between a 15 year mortgage versus a 30 year.

Pre-Payment Penalties

Some lenders may have prepayment penalties, meaning you will be charged a fee if you pay off your loan early.

It’s a good idea to ask your lender about such fees and factor them into your decision-making process.

Refinance

Look into refinancing your loan if you are paying more interest charges than you need to be.

Refinancing can help you secure a lower interest rate or change the terms of your loan to better fit your financial situation.

Having a budget in place and sticking to it when managing your loans is also essential. This can help you make the necessary payments on time, avoid late fees, and stay on track to paying off your loans efficiently.

Having an emergency fund in place can also be helpful in case you experience a financial setback and cannot make your loan payments.

This can help you avoid falling behind on your payments and potentially damaging your credit score.

Finally, it’s a good idea to communicate with your lender if you need help making your loan payments.

Many lenders are willing to work with borrowers to find a solution that fits their financial situation. This could involve changing the terms of the loan, deferring payments, or even forbearance.

Conclusion

Paying off the principal and paying interest are important considerations when managing your loans. By having a budget in place, having an emergency fund, communicating with your lender, and regularly reviewing your loan terms, you can make informed decisions about your finances and ensure that you are on track to paying off your loans efficiently.

Are you ready to apply? Start the process by completing the form below.