Closing costs are the fees you pay when finalizing a real estate transaction, whether you’re refinancing a mortgage or buying a new home.

When buying a home in Texas, it is important for home buyers to understand the closing costs.

These costs are associated with the purchase of a home and must be paid in order to complete the transaction.

Closing costs can vary depending on the location of the property, but there are some standard costs that apply in most cases.

In this article, we will discuss what home buyers need to know about closing costs in Texas!

What are the typical closing costs in Texas?

Closing costs are the fees associated with the purchase of a home.

These fees include things like the loan origination fee, underwriting and processing fees, title insurance, escrow fees, appraisal, homeowners insurance policy, interest, recording fees, termite inspections, doc prep fees, survey, etc..

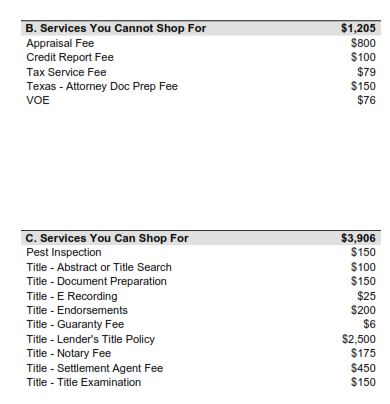

Here is an example of some closing costs for a transaction that we recently completed in Humble, Texas. This example is for a VA purchase loan with a $350,000 purchase price.

These costs would also be the same for an Texas FHA Loan and a Texas Cash Out Refinance except the appraisal for an FHA loan would be less.

Who pays for closing costs in Texas?

In most cases, closing costs are paid by the home buyer. However, there are some instances where the seller may pay for some or all of the buyers costs.

This would need to be agreed on in writing, and is usually presented to the seller when making an offer on the house.

Talk to your realtor about wether or not it’s a good idea. In certain markets, like a sellers market its not a common request.

Related: How to Get your Offer Accepted in a Seller’s Market

Closing costs can be paid by:

- Seller Credit

- A combination of seller credit plus funds from your own account

- A gift from a family member

- A loan from 401K can also be another option (there is usually no penalty when it’s for a purchase of a home. Double check with your 401k provider)

How much are closing costs in Texas?

The amount of closing costs can vary depending on the price of the home and the location. In Texas, common closing costs include the loan origination fee, title insurance, and escrow fees. These fees can add up, so it is important for home buyers to know what their closing costs are before beginning the home buying process.

On average, closing costs are usually 3% to 4% of the purchase price. This includes your escrow account for property taxes and homeowners insurance.

Your loan officer or real estate agent, will be able to provide help on estimating what the closing costs would be. They will be able to give you a more accurate estimate based on your specific situation.

It is important to remember that these costs are an important part of the home buying process.

Be sure to factor them into your budget so that you can close on your new home without any surprises!

Can closing costs be rolled into the loan?

If you are purchasing a home, no, you can not roll costs into the loan. This is only allowed on refinances.

If you need help with closing costs, we do have a mortgage program that will help you finance the costs by adding a second mortgage to the loan.

Closing Cost the same as down payment?

The down payment on a home is not the same as closing costs. Closing costs are charges for services like escrow, appraisal, title, underwriting. These costs are separate from the down payment.

The closing charges can be paid by you as the buyer, or can be negotiated to be paid by the seller.

The down payment cannot be paid by the seller.

More info that may interest you:

- What’s the First Step in Buying a House

- How to Buy a Home for the First Time: A Guide

- Earnest Money – What is Earnest Money and is it Required?

- Closing Time: What to Expect When You’re Closing on a New House

Categories

Latest Post

- Are property taxes included in the mortgage?

- Property Taxes

- What are the 4 c’s of credit?

- What is an appraisal contingency?

- Flying Solo: Purchasing a Home Without Your Spouse in Texas

- The Real Reason Underwriters Deny Loans – What You Need to Know

- Stretch Your Home Buying Budget with a 40-Year Mortgage

- Save Money on Your Mortgage with a No Closing Cost Option

- Co-Borrowers on a Mortgage: Everything You Need to Know

- Maximize Your Home Buying Budget: Lender Credits 101